Cryptocurrency trading is gaining popularity among users. Many realize that this is a complex process that requires some training and skills. Therefore, users are trying to find a way out and use bots to trade cryptocurrency. But how correct is this approach and is it possible to earn something in the future with the help of robots? Automated trading has long established itself in binary options trading and Forex, and now it has come to cryptocurrency exchanges.

If the limits are exceeded, the exchange issues an IP ban for 2 minutes, so the bot continuously monitors the loading of the API, when it approaches the norm, operations will be executed with a delay. In general, you don't have to worry as long as the indicator is half full; if it turns red, then it will not be long before the limit is exceeded, and the bot will start inserting delays into commands.

For the same reason, the data loading at the start of the bot on binance is divided into 2 stages. First of all, the most necessary data is loaded - volumes, prices, order books with depth of orders. These data are only needed to calculate the Pump Q binance bot for trading on the stock exchange, namely, the order books are loaded with the depth of orders to calculate the walls. The SuperFast2 autodetect method does not work on binance, as constant order book monitoring will eat up the API limit needed to manage orders.

Binas has restrictions on the number of coins in an order, min. If you pay a commission in bitcoins, then there will be fractional shares of coins that cannot be sold. Bots for Binance cannot be run simultaneously from two machines on the same network from the same IP! API requests are cumulative, which will result in an instant ban for 2 minutes.

If you have accounts on binance and bitrex, the bot can be switched between exchanges in the settings: But it's better to make a separate folder for each exchange by copying the Moon Bot folder. Binance bot for trading on the exchange one folder with a bot with a setting for bitrex, in another for binance. In this case, bots can be launched simultaneously. Learn more about binance trading bot.

Binance trading bot

It is important to clearly understand what is needed for this, competently organize the work process and not be scattered on trifles. Because, here is everything you need for successful trading: Some drawback could be called the lack of support for traditional fiat currencies, but this inconvenience is easily compensated with the help of a special exchange option. Please note that in order to move a fragment into a cell, you need to move the slider at the bottom of the picture with the mouse cursor, and not the detail itself. However, this is a very simple matter. All Far Eastern cryptocurrency exchange services have a similar feature. And although the management plans to move to Malta, in principle it is a Chinese crypto platform, albeit with an international orientation.

Cryptocurrency trading bot. Trading bots on bitcoin exchanges: holy grail or empty idea?

Earnings are on different timeframes from short to long. Arbitrage Operates on two or more cryptocurrency trading robots, the main earnings on the difference of the cryptocurrency trading robot. In the Telegram channel Looking for buyers or sellers in Telegram. Bots for collecting cryptocurrency through faucets Faucets are online services, a cryptocurrency trading robot distributing Satoshi or other cryptocurrency pennies. There are no good robots that can make decent money on faucets, there are only promising, but not ideally working, developments. To conduct an independent analysis, you will need historical data on changes in the cryptocurrency trading robot charts for at least the last year, sometimes it is possible to detect a relationship with the news. In addition, after determining the patterns, the strategy is tested on the same historical data the number of potential losses and profits is calculated. And if the results are satisfactory, the rules of the trading strategy of the robot for the cryptocurrency exchange are created on their basis. Some bots additionally use indicators that allow you to analyze the current situation on the market, others are executed only when certain market conditions occur. The trading strategy of exchange and arbitrage bots for a cryptocurrency trading robot should be very simple, for example, as follows: When the price of a cryptocurrency drops, you need to buy it. others are executed only when certain market conditions occur. The trading strategy of exchange and arbitrage bots for a cryptocurrency trading robot should be very simple, for example, as follows: When the price of a cryptocurrency drops, you need to buy it. others are executed only when certain market conditions occur. The trading strategy of exchange and arbitrage bots for a cryptocurrency trading robot should be very simple, for example, as follows: When the price of a cryptocurrency drops, you need to buy it.

Advantages and disadvantages of cryptocurrency trading with robots

To some extent, all crypto exchanges provide it. Everywhere you can, for example, conclude deals; most resources have simple graphics. But for full-fledged trading, this is usually not enough. The way out is special platforms - trading terminals for trading cryptocurrency.

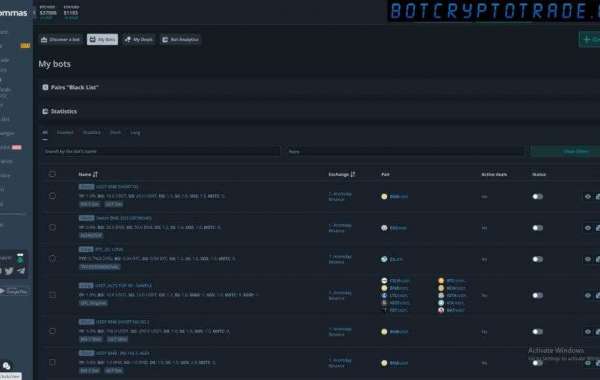

After registration, you should choose the trading mode that suits you: the bot automatically trades or the manual bot sends signals, and you trade on your own.

Bot for automated cryptocurrency trading

You have probably already heard something about the automation of cryptocurrency trading on the stock exchange. Such algorithms are sold on anonymous forums and naturally there will be no technical support and guarantees. Today we will talk about a slightly different technology, the developers of which are interested in constant profit, since the commission for the service is taken only from successful transactions. In fact, it can be said that you rent this algorithm and pay for it only when it makes a profit for you. This is the best and easiest to set up automatic cryptocurrency trading bot that I have ever used. The main advantages of the Apitrade trading bot:. Apitrade automation service uses three independent strategies for automatic earnings on the stock exchange.

Applications for trading on the cryptocurrencies exchange

As noted, efficient trading on modern financial markets is possible without the direct participation of a speculator in the auction. This is also relevant today for cryptocurrency exchanges, where the competent use of the capabilities of cryptobots is capable of a trading robot for a binance trader with a stable profit. So, a cryptocurrency robot bot is a specially created algorithm that uses different indicators, as well as a scanner software system that recognizes market entry points and makes transactions on behalf of the user. In such a rapidly developing segment as the crypto market, the possibility of automating the trading process is in great demand. Traders who have the skills of a trading robot for binance and programming knowledge can create their own cryptobots or competently optimize existing advisors for efficient trading of digital coins.

Overview of trading bots for cryptocurrencies

Subscribe to be aware of the most interesting from the world of cryptocurrencies. Standard exchange practices that are successful with fiat money or securities may not work with digital currency. Experienced traders do not always succeed in responding to a change in quotes for alternative money, what can we say about a beginner. Cryptocurrency trading bot summary A trading bot is a computer program or integrated script that interacts directly with financial exchanges often using APIs to obtain and interpret relevant information and performs a cryptocurrency trading bot to buy or sell on your behalf depending on certain market data.

Cryptocurrency automated trading bot: principle of operation and advanced software solutions

Cryptocurrencies continue to be an unusually interesting phenomenon of our time. Having quickly achieved popularity and become very popular, digital coins continue to be an incredibly profitable investment tool that can give huge profits on cryptocurrency exchanges or with long-term investments in these assets. Experienced speculators create their capital in this way. On the sites where trading operations with Bitcoin, altcoins and other cryptoassets take place, you can make a profit by opening positions manually after analyzing the market, studying the price chart, viewing data from technical indicators, etc. However, the 21st century has given the opportunity to carry out effective crypto trading in automatic mode , through special cryptobots.

Cryptobot for trading

Unlike stock markets, the cryptocurrency market never closes and never sleeps, which can be a very stressful scenario for traders and even smaller investors in the industry. Users familiar with cryptocurrencies will also be familiar with the feeling of waking up in the morning and checking their crypto portfolio, waiting for a pleasant or unpleasant surprise and seeing big profits or losses. As a result of market volatility, trading bots are becoming more and more popular among traders, allowing them to constantly monitor their trading, and the bot does not sleep even when the trader is offline sleeping or at work and so on. In addition, the right bot allows you to make transactions faster and more efficiently than a trader could do it manually. The explosion in popularity in cryptocurrencies has also led to a large increase in the number of crypto trading robots, both free and licensed with pay-per-use. However, it is difficult to determine which ones work as intended and which ones are an absolute waste of time or money.